Liquidity Pool Staking

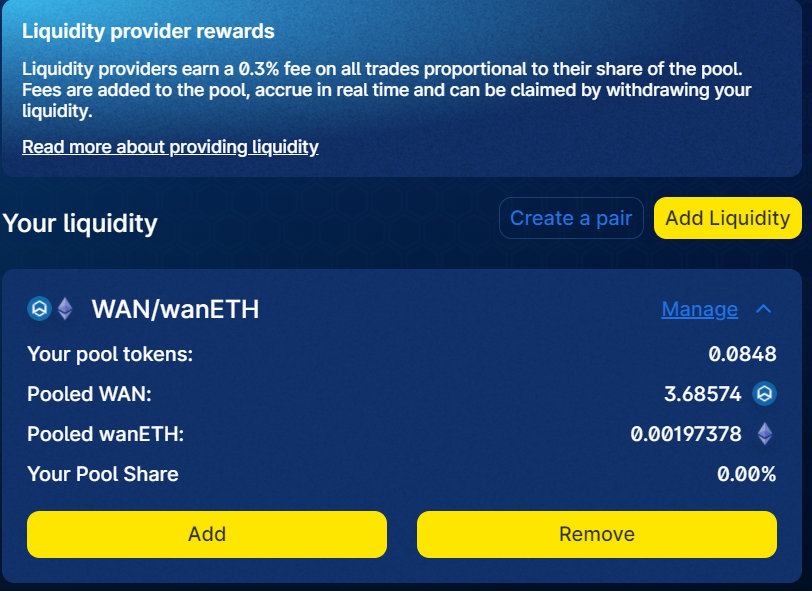

In the next section in the top bar, ‘Pool’, you can add liquidity to WanSwap. In the previous section, we mentioned that traders in fact trade with the liquidity pool. The funds in the liquidity pool can be provided by any user (liquidity providers). By staking funds into the liquidity pool, the liquidity providers own a share of the pool and hence can collect the trading fees generated by the pool. Any user can provide liquidity to WanSwap to earn transaction fees. You can either create a trading pair or add liquidity to an existing pair.

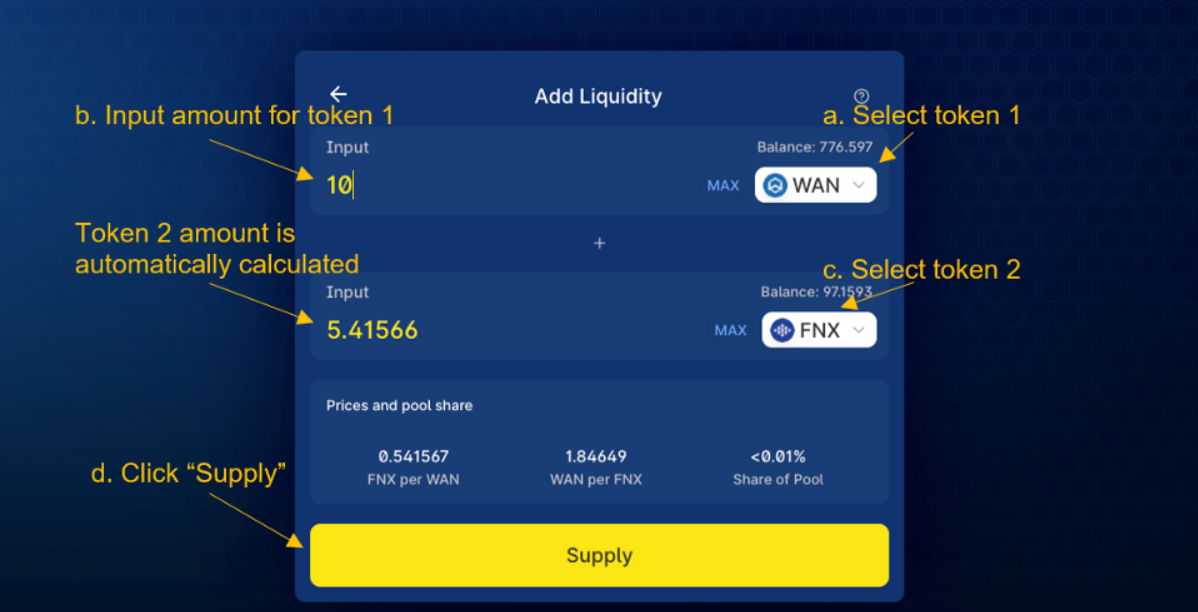

The following figure shows the ‘Add Liquidity’ interface. Users can add liquidity with just a few clicks. Afterward, liquidity providers get WSLP liquidity tokens. These tokens represent their shares in the pool and will be used to withdraw funds or in the yield farm.

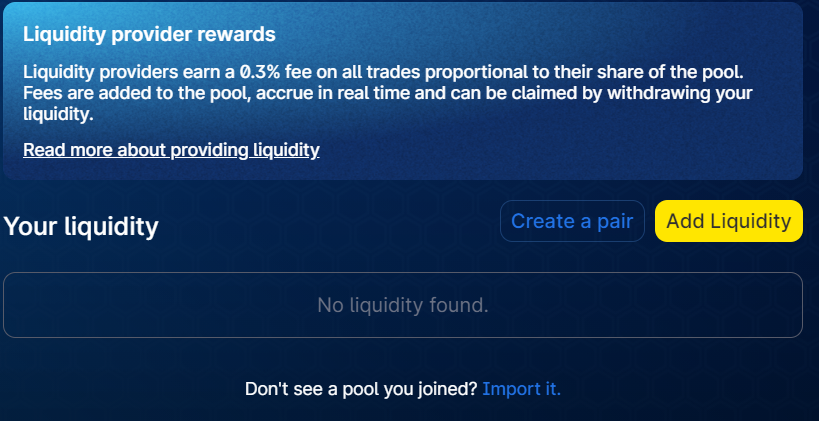

When you deposit your WSLP tokens for farming, the details of the deposited liquidity are not visible in the pool tab. If you can’t see the details of a pair you provided liquidity for and that was not used for farming, you can import it. Click on ‘import it’.

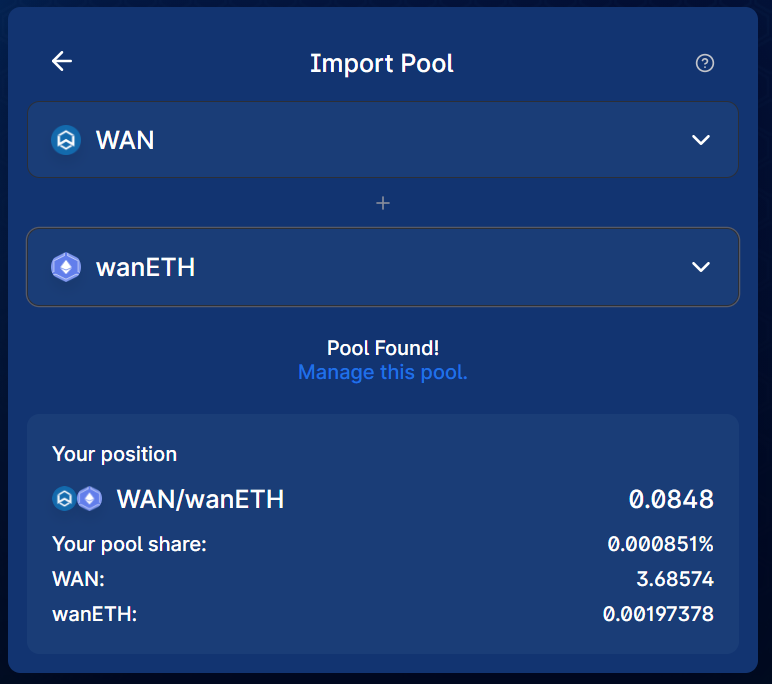

Now put in the data. If everything is correct you will see the details of your liquidity provided. Click on ‘Manage this pool’ to add it to the pool tab.

The amount of tokens can differ from the amount you initially provided. For more information on this check this guide.